LOANOLOGY

RATES & TERMS

Loan Terms

Loan terms define how long you have to repay and the structure of your payments. Monthly principal and interest payments, with no balloon payments for SBA loans, ensuring predictable cash flow for your business.

Here’s what to expect:

Conventional Loan Terms

Purpose: Similar to SBA loans—working capital, equipment, or real estate—but with stricter qualifications.

Term Lengths:

5–7 years for working capital or equipment.

10–20 years for real estate or large acquisitions.

Repayment Structure: May include balloon payments or adjustable terms, depending on the lender, which can impact cash flow for a multi-unit expansion.

SBA 7(a) Loans (Standard and Express):

Purpose: Working capital, equipment, real estate, or acquisitions for a retail or service business.

Term Lengths:

Up to 7 years for working capital or inventory.

Up to 10 years for equipment or business acquisitions.

Up to 25 years for real estate purchases or improvements.

Example: A $500,000 7(a) loan for equipment has a 10-year term, while a $1 million real estate loan gets 25 years.

SBA 504 Loans:

Purpose: Fixed assets like real estate or heavy equipment for a multi-unit or rural business.

Term Lengths:

10–20 years for equipment.

20–25 years for real estate.

Structure: Combines a bank loan (50%), CDC loan (40%), and 10% borrower injection, with fixed rates.

SBA Microloans:

Purpose: Startup costs, inventory, or small equipment for a rural or single-unit startup.

Term Length: Up to 6 years.

Interest Rates

Interest rates determine your borrowing cost. SBA loans use the WSJ Prime Rate as a base, while conventional loans often use the 10-Year Treasury Rate. Here’s how they work:

Currently the prime rate is at 7.50%.

Conventional Loan Interest Rates

Base Rate: Typically the 10-Year Treasury Rate (assumed ~4% as of June 2025, subject to market changes) or, less commonly, WSJ Prime Rate (7.5%).

Rate Structure: Fixed or variable, with spreads of 2–5% over the base rate, resulting in rates of 6–9% (Treasury-based) or 9–12% (Prime-based).

Fixed vs. Variable: Fixed rates are common but higher (7–10%); variable rates may start lower (6–8%) but fluctuate, affecting cash flow for a retail expansion.

SBA Loan Interest Rates

Base Rate: WSJ Prime Rate (currently 7.5% as of June 2025, subject to change).

Rate Structure: Variable or fixed, with SBA capping the spread (additional percentage added to the base rate) based on loan amount and type.

7(a) Variable Rate Maximums (Prime + Spread):

$50,000 or less: Prime + 6.5% = 14.0% max (7.5% + 6.5%).

$50,001–$250,000: Prime + 6.0% = 13.5% max.

$250,001–$350,000: Prime + 4.5% = 12.0% max.

Over $350,000: Prime + 3.0% = 10.5% max.

7(a) Fixed Rate Maximums: Same spreads as variable rates, but lenders may charge slightly higher rates (within caps) for fixed-rate stability, often 10–12% for a $1 million loan.

Express Loans: Follow 7(a) rate caps, typically variable, ranging from 9.5–13.5% depending on loan size.

504 Loans:

Rate Structure: Fixed, blending a bank loan (market rates, ~7–9%) and CDC loan (based on 5- or 10-Year Treasury, ~4–6%).

Effective Rate: Typically 5–7%, lower than 7(a) loans, ideal for real estate purchases like a rural service business.

Microloans:

Rate Structure: Fixed or variable, set by nonprofit intermediaries, typically 6–9%.

Express Loans:

Follow 7(a) rate caps, typically variable, ranging from 9.5–13.5% depending on loan size.

Rate Caps and Trends

SBA Caps: Ensure predictability, with 7(a) maximums (10.5–14.0%) lower than historical highs (e.g., 21.5% WSJ Prime in 1980). Rates remain competitive compared to pre-2008 peaks (8.25% in 2006).

Market Trends: The WSJ Prime Rate (7.5%) reflects post-2024 adjustments, stable but subject to economic shifts. The 10-Year Treasury (~4%) offers a lower base for conventional loans but is sensitive to market changes.

Why It Matters: Understanding caps and trends helps you budget for loan costs, like a $500,000 Express loan at 10.5% vs. a conventional loan at 8%.

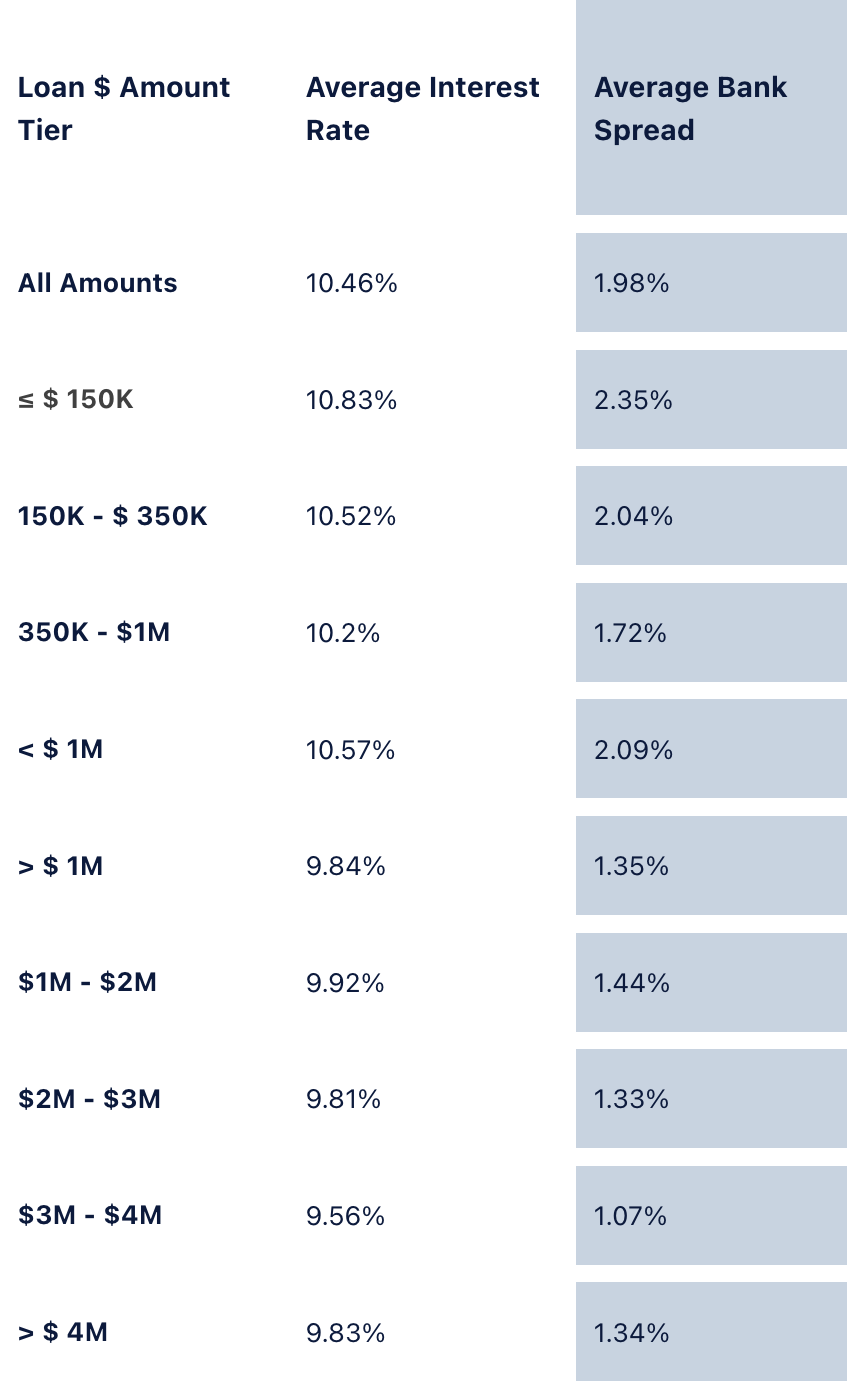

NON-FRANCHISE BUSINESSES

AVERAGE INTEREST RATES OVER LAST YEAR

LAST 12 MONTHS ENDING MID-YEAR 2024

STARTUPS

CHANGE OF OWNERSHIP

BUSINESSES < 2 YEARS

BUSINESSES > 2 YEARS

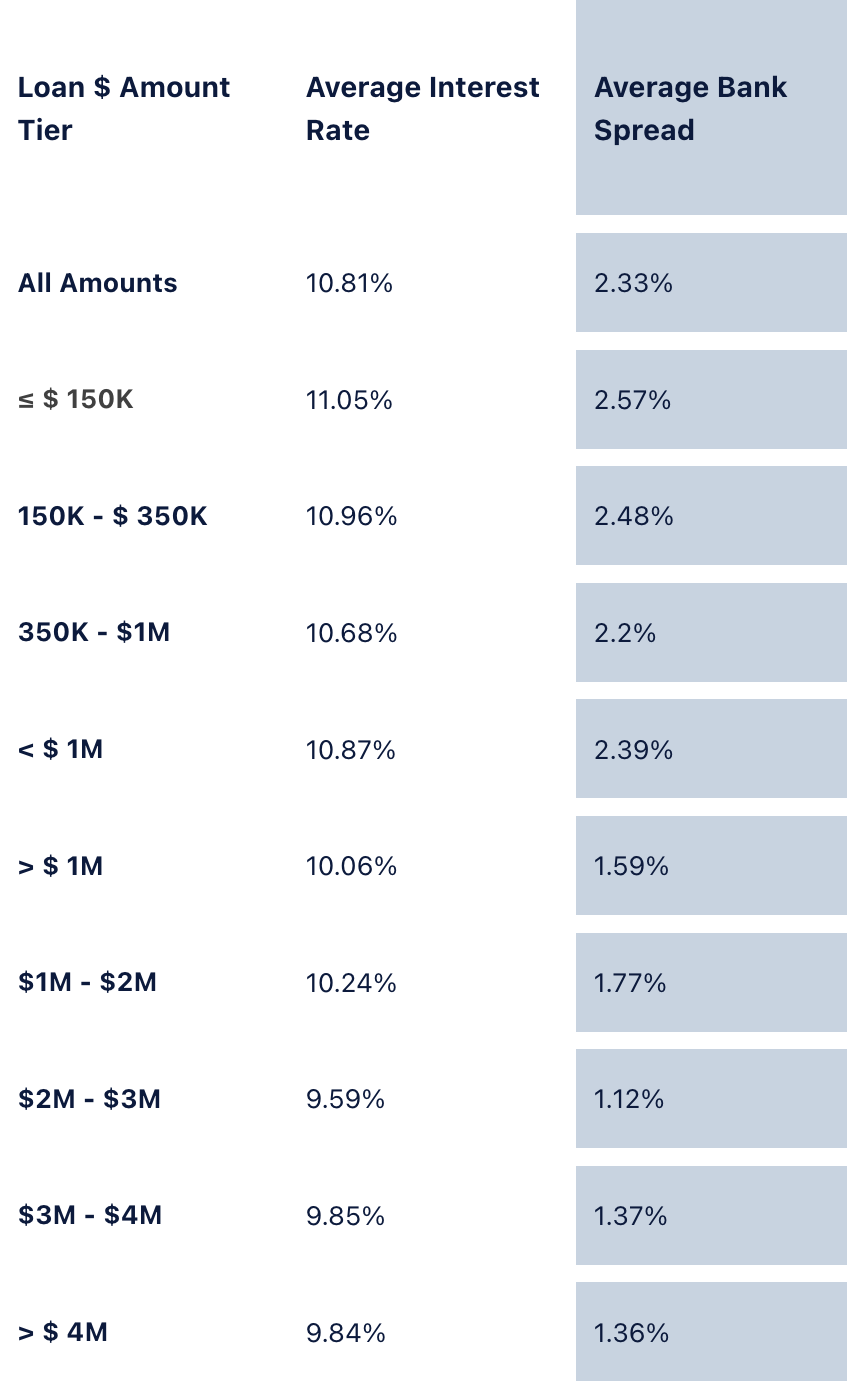

FRANCHISE BUSINESSES

AVERAGE INTEREST RATES OVER LAST YEAR

LAST 12 MONTHS ENDING MID-YEAR 2024

STARTUPS

CHANGE OF OWNERSHIP

BUSINESSES < 2 YEARS

BUSINESSES > 2 YEARS

LoanBox Loanology provides independent insights into small business lending based on what we know can be accomplished with most LoanBox lenders. However, there may be some policy, perspective, or viewpoint we share which may not reflect those of all lenders on our platform, as each brings unique policies. LoanBox lenders brings diverse policies and perspectives so not all lenders will be able to assist or even agree with all of the tips, strategies, articles, guides, and insights we provide for small business owner borrowers. Lenders are not responsible, liable or obligated for the content or advice provided in Loanology or on LoanBox.com. For specific guidance, use the search bar or just contact us directly and speak to a LoanBox Advisor.